Remedy and Recovery of Stolen Crypto Assets Under the GENIUS Act: A New Era in U.S. Digital Asset Enforcement

- Tubrazy Shahid

- Aug 4, 2025

- 3 min read

The rise in cryptocurrency scams and hacks—ranging from phishing attacks to rug pulls—has long plagued investors with little recourse due to regulatory uncertainty. However, the GENIUS Act (Guarding Education, National Interests, and Uplifting Security Act), introduced in the U.S. as a comprehensive crypto regulatory framework, brings a structured legal mechanism to the remedy and recovery of stolen or scammed digital assets.

Let’s explore how the GENIUS Act addresses this critical challenge.

🔍 The Need for Recovery Mechanisms in the Crypto Space

Victims of crypto fraud often find themselves trapped in a legal grey zone. Traditional asset recovery frameworks struggle with:

The pseudonymity of blockchain transactions,

Jurisdictional complexity in tracing funds,

Lack of clear definitions of digital asset crimes, and

Limited power of law enforcement to seize or freeze crypto assets.

The GENIUS Act seeks to correct this by providing defined pathways for investigation, recovery, and restitution.

⚖️ Key Recovery Mechanisms Introduced by the GENIUS Act

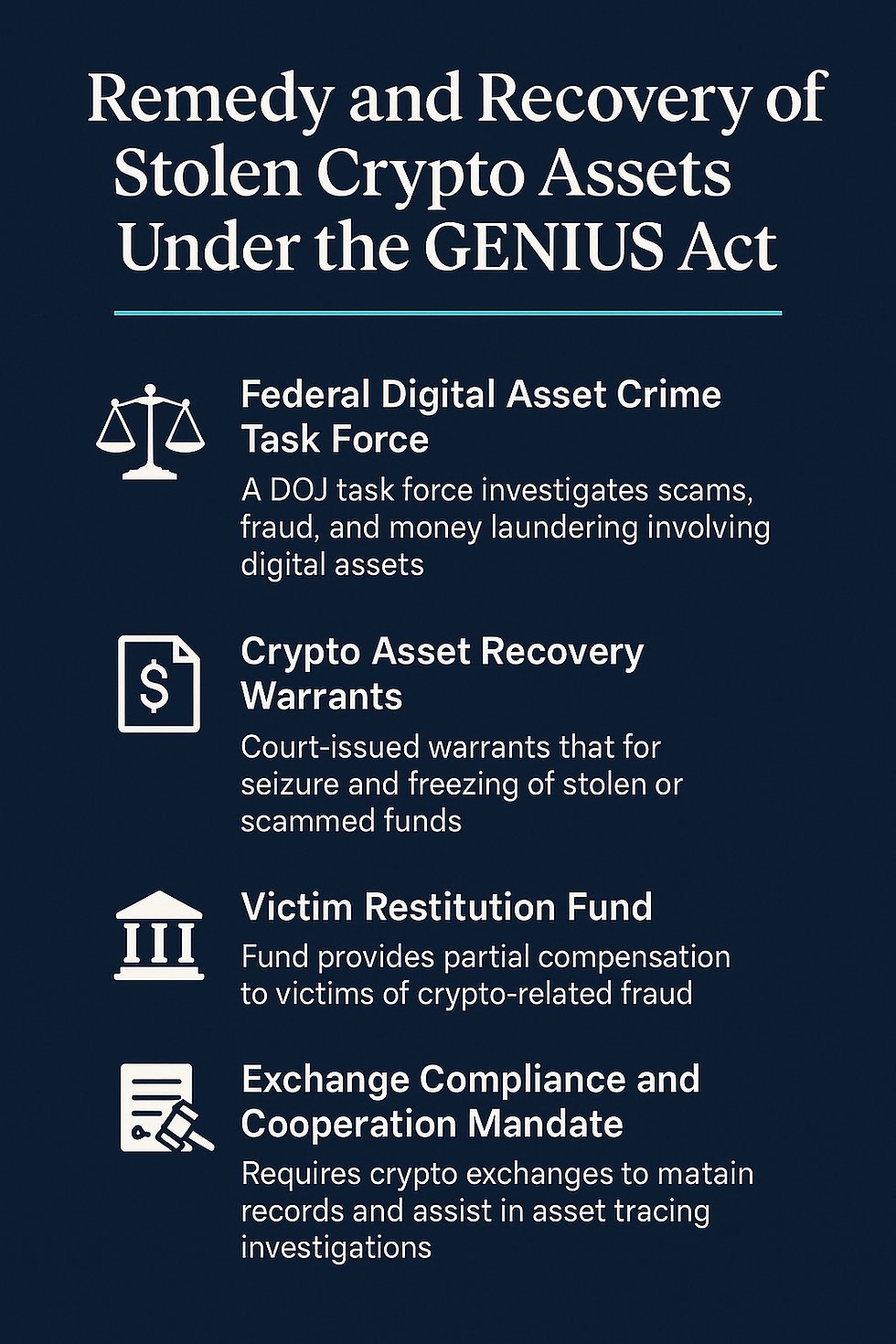

1. Federal Digital Asset Crime Task Force

A major highlight of the Act is the creation of a Digital Asset Crime Enforcement Task Force within the Department of Justice (DOJ). This task force is empowered to:

Investigate scams, fraud, and money laundering involving digital assets,

Coordinate with foreign regulators and law enforcement,

Fast-track subpoenas and asset freezing orders.

2. Crypto Asset Recovery Warrants

Under the Act, courts may issue Crypto Asset Recovery Warrants (CARWs) enabling:

Seizure of funds held in domestic or foreign exchanges,

Real-time blockchain monitoring through authorized forensic firms,

Authorization of emergency freezing orders without prior notice to prevent dissipation of assets.

3. Victim Restitution Fund

The GENIUS Act proposes the establishment of a Federal Digital Asset Victim Restitution Fund, financed through:

Penalties and fines collected from convicted fraudsters,

Forfeited illicit assets, and

Contributions from regulated exchanges as part of compliance levies.

This fund offers partial compensation to victims whose assets cannot be recovered in full.

4. Exchange Compliance and Cooperation Mandate

The Act compels U.S.-based crypto exchanges to:

Maintain full transaction logs for five years,

Cooperate with asset tracing investigations,

Provide information to the task force within 48 hours of request,

Freeze assets upon issuance of a CARW.

Failure to comply could result in suspension of licensing or heavy civil penalties.

🛡️ Civil Remedies for Victims

Victims are granted standing to:

File civil suits for constructive trust and unjust enrichment,

Seek injunctive relief to prevent the transfer of stolen crypto,

Join class action suits in federal court where a scam affects multiple parties.

Under the GENIUS Act, courts are also encouraged to recognize and enforce blockchain forensic evidence as admissible in recovery proceedings.

🌐 Cross-Border Recovery: International Coordination

Recognizing the borderless nature of crypto, the GENIUS Act mandates:

U.S. participation in international asset recovery coalitions,

Bilateral agreements for recognition and enforcement of recovery orders,

Sharing of blockchain forensic intelligence with allied regulators.

This ensures that even if funds are moved through foreign platforms or mixers, recovery remains possible.

🚨 Practical Impact: What This Means for Crypto Victims

The GENIUS Act brings hope to scam victims and teeth to enforcement agencies. It shifts the legal system from reactive to proactive. Victims can now expect:

Government support in tracing and freezing funds,

Defined legal avenues for restitution, and

Accountability of exchanges for hosting criminal activity.

⚠️ Final Thoughts

The GENIUS Act marks a transformational moment in U.S. crypto legislation. By incorporating advanced legal remedies, forensic mandates, and victim compensation mechanisms, it fills a long-standing gap in crypto asset protection. While the law still faces practical hurdles—especially in cross-border enforcement—the direction is clear: crypto scammers are no longer untouchable, and victims are no longer powerless.

#GENIUSAct #CryptoRecovery #DigitalAssetLaw #CryptoScams #BlockchainForensics #VictimRestitution #CryptoRegulation #USDOJ #StolenCrypto #AssetFreezing #InvestorProtection #CryptoLaw

Disclaimer

The information provided in this article is for general informational purposes only and does not constitute legal or financial advice.

Author & Crypto Consultant

Shahid Jamal Tubrazy (Crypto & Fintech Law Consultant)

Shahid Jamal Tubrazy, a certified top expert in Crypto Law from Duke University, is a leading authority in the cryptocurrency and blockchain space. As a seasoned Fintech lawyer, he offers a full spectrum of services, including licensing, legal guidance for ICOs, STOs, DeFi, and DAOs, as well as specialized expertise in crypto mediation, negotiation, and mergers and acquisitions. With a proven track record and published works on Blockchain Regulation and Cryptocurrency Laws, Shahid provides unparalleled insights into the complexities of the fintech world, ensuring compliance and strategic success. 🌐💼 #CryptoLaw #Fintech #Blockchain #LicenseServices #CryptoMediator #MergersAndAcquisitions #CryptoCompliance #FrozenAssetsrecovery.

EMAIL: shahidtubrazy@gmail.com

Comments